February 8th, 2022

8th of March 2021

Spring Budget 2021 – Extension of Furlough

Published by Sarah Bufton

The Chancellor of the Exchequer, Rishi Sunak, delivered the Spring Budget on Wednesday 3 March 2021. The headline measures largely consisted of confirmation that coronavirus support measures will continue, perhaps for a longer period than had been expected.

Coronavirus Job Retention Scheme (CJRS)

The government announced that the CJRS will be extended for a further five months until the end of September 2021.

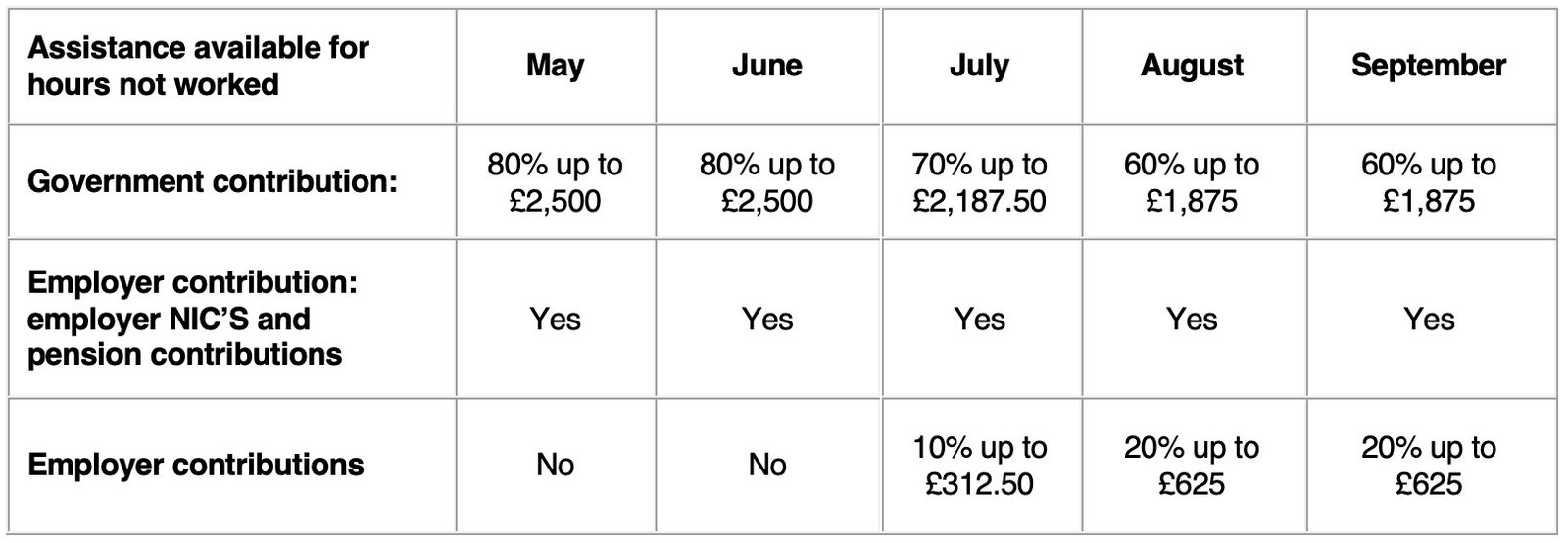

Under the extension, there will be no requirement for employers to contribute, other than Employer National Insurance Contributions (NICs) and pensions, in each of April, May and June. In July, employers will be required to pay 10% of a furloughed employee’s salary, with employers’ required contributions increasing to 20% in August and September.

This is to allow for the gradual phase out of the scheme.

Below is a table summarising the contributions required from the Government and Employer for any hours not worked.

Who can be furloughed?

Under the current scheme staff can only be furloughed if they were employed on or before 30th October 2020. For furlough periods starting from 1st May 2021, employees who were employed on 2nd March 2021 can be furloughed, but a PAYE submission must have been made by 2nd March 2021.

Is Flexible Furlough still allowed?

Flexible furlough is still possible under the extension. Employees can work reduced hours with the unworked hours being furloughed.

Furlough Agreements

You must ensure you confirm any furlough arrangement on or before the period of furlough. This can no longer be carried out retrospectively. You must keep a written record of the agreement for five years, as well as records of the hours worked and on furlough.

For assistance with furlough or any other Employment issues please do not hesitate to contact our Sarah Bufton on 01664 563162 or [email protected]

Latest news

January 28th, 2022

January 11th, 2022

November 10th, 2021

October 1st, 2021

March 8th, 2021